Medicare Advantage vs Medigap (Medicare Supplement)

As you may know by now, Medicare which is a federal government health insurance program in the United States doesn’t cover everything. Most people buy additional insurance to bridge the gaps. When considering Medigap vs Medicare Advantage, it’s important to understand that both types of Medicare plans will help to reduce yours out-of-pocket spending.

After all, who wants to come up with a $1500+ deductible each time you enter the hospital? Or shell out 20% of the cost of an expensive MRI?

So the two main types of coverage that you can buy to help with this are Medicare Advantage or Medigap (Medicare Supplement). It’s important that you know how each type of coverage works, so you can select the right plan for you.

Medicare Advantage vs Medigap:

Choosing a Winner

Medicare Supplement vs Medicare Advantage. Which one is right for you?

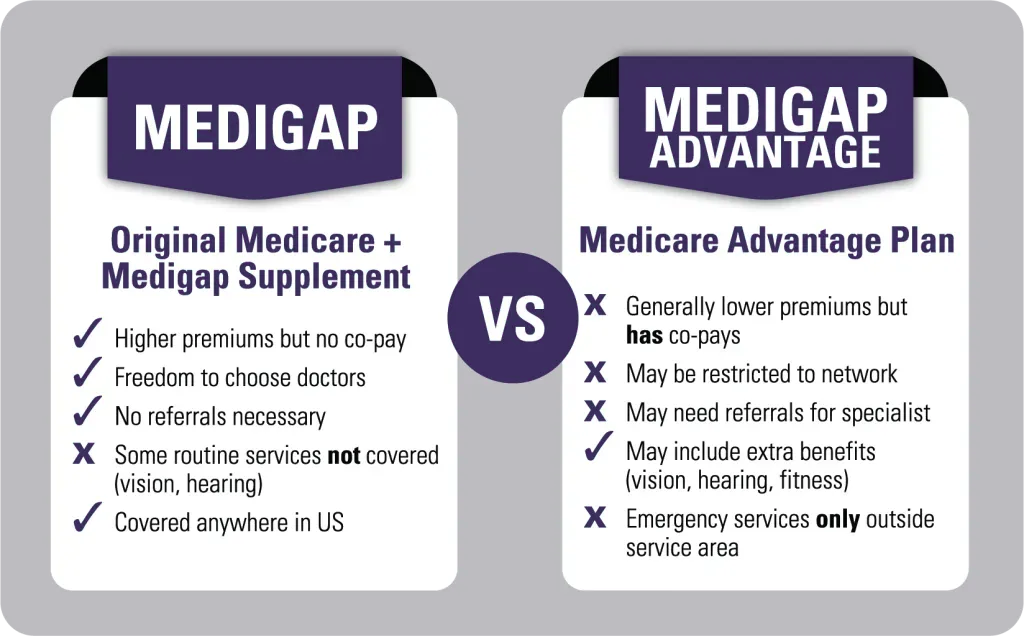

Though both policies help you cover your gaps in Medicare, they are designed very differently.

Medicare supplements pay as secondary insurance to Medicare Part A and Part B. This means they pay after Medicare first pays its portion of the bill. You stay enrolled in Original Medicare, and Medicare sends the remainder of your bills to your supplemental company. Then the supplement company pays its share according to which plan you are enrolled in. Each Medigap plan provides different benefits and the top three most popular plans are Plan F, Plan G, and Plan N.

Medicare Advantage plans, on the other hand, are entirely separate from Medicare. When you enroll into a Medicare Advantage policy, you get your benefits from the plan, not Medicare. You agree to use the plan’s network of providers except when you need emergency care. You’ll pay copayments for your health care treatment as you go along. Think of these plans as an alternative to Original Medicare.

Let’s explore a bit more about these coverage options to understand the differences between the two.

About Medicare Supplement Plans

Medicare supplement plans are also called Medigap plans. Having a Medigap policy means you are still enrolled in Original Medicare as your primary health coverage.

You can see any provider that participates in Medicare, regardless of which supplement company you choose. A primary care doctor does not need to be chosen with a Medigap plan unlike HMO Advantage plans. You have access to all the Medicare providers nationwide – no referrals necessary. If you enroll in a comprehensive plan like Plan F, or Plan G, you will have very little out of pocket. Not even doctor copays or coinsurance! Since Medicare covers medically necessary doctor visits, specialist care, other office visits, surgery, procedures and exams, your Medicare Supplement plans will as well.

When you enroll, your Medicare supplement insurance company notifies Medicare that you have purchased a policy. Thereafter, as we described earlier, when Medicare pays its portion of your bills, it will automatically send the remainder of your bill to your Medicare Supplement insurer.

It’s seamless, with no claim forms for you to file.

Freedom of Access & No Referrals Necessary

Medicare Supplement insurance policies also offer you the most freedom of access to providers. You have the freedom to choose your own doctors and hospitals from among the 900,000+ Medicare providers in the country. Patients do not need referrals to see specialists on this type of coverage.

Medigap plans allow you to see any doctor in the nation that participates in Medicare

Because these plans offer you the most freedom and flexibility, they have higher premiums than Medicare Advantage plans. In the DFW area, for example, a female, non-tobacco user turning 65 might pay around $100 – $130/month for Plan G in 2022.

It depends on which Medigap plan is chosen and whether that individual uses tobacco. Plans and rates also vary by region, age, and sometimes gender, but our agency can quote over 30 insurance carriers in 48 states. We can also check to see which carriers offer household discounts that might give you the opportunity to reduce your monthly premiums.

Additionally, some Medigap plans provide foreign travel emergency coverage when enrollees are outside the U.S. Insurers will cover 80% of the cost for emergency services the enrollee pays the $250 deductible.

Your Retail Drug Coverage is Separate

Medigap plans cover medications administered in a hospital setting, such as injectables or chemotherapy drugs. They do not cover retail medications though, so most beneficiaries will enroll in a separate Medicare Part D plan for prescription drug coverage. Part D plans are available in every state starting around $10/month. If you fail to enroll in a Part D plan and do not have creditable coverage, you will receive a late enrollment penalty when you apply in the future.

Medigap Enrollments

If you enroll into a Medigap plan during your one-time open enrollment window (within 6 months of your Part B effective date), there are no health questions. The insurance company will approve your application. A majority of Medigap enrollees will enroll in a Medigap plan during this window.

There are also no waiting periods or pre-existing condition exclusions when you apply during this window. If you miss this window and apply later on, then you will usually be required to answer a number of medical questions and be underwritten. Underwriting rules will vary with each carrier and state. The underwriter at the insurance company can accept or decline you based on your medical history.

About Medicare Advantage

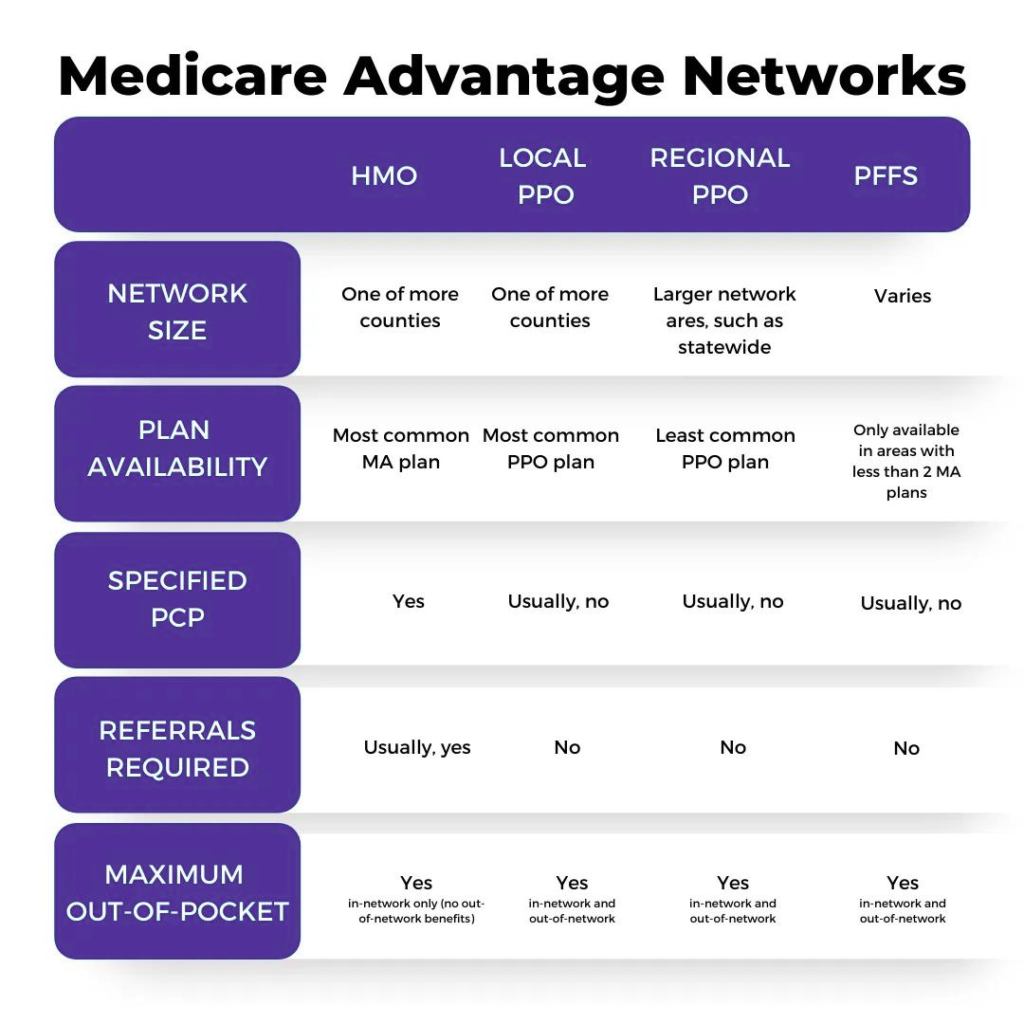

About 44% of beneficiaries choose to enroll into Medicare Advantage policies, which are private insurance plans. They usually have lower premiums than Medigap plans….sometimes even a $0 premium on some plans in some areas. There are several kinds of Advantage programs such as HMO, PPO, PFFS (private-fee-for service), and SNPs (Special Needs Plans).

When a plan has a $0 premium, it means that you will pay no additional premiums for the plan itself. You will still pay for your Part B premiums monthly though. A beneficiary must be enrolled in both Medicare Part A and Medicare Part B to be eligible for a Medicare Advantage plan. However, you don’t need to enroll in a Part D plan since most Advantage plans include prescription drug benefits.

Why would any company offer a $0 premium plan? Because you agree to use the plan’s network providers to get your care. This means you’ll have substantially fewer doctors to choose from than if you choose a Medigap plan. The insurance company has more control over your choice of providers and facilities, with whom they negotiate contracted rates.

Check Your Doctors

It’s important to check with your doctors first to see if they are in the plan’s network, as well as your go-to hospital facility. This is especially essential if the Advantage plan you are considering is an HMO (health maintenance organization) plan, which often has the smallest networks. I have seen HMOs with networks as small as 250 doctors, which is tiny, so you must do your homework on this and search physicians around your location to make sure they accept your plan. You will also want to note that PPOs can offer a wider range, but your cost-sharing will likely be higher.

Look for one with a network that has plenty of providers in your service area. According to the Kaiser Family Foundation, a Medicare beneficiary has more than 30 Advantage plans on average available to them in their zip code.

Your Medicare Advantage insurance company will pay your healthcare bills instead of Medicare paying them. You will pay copays for the services you obtain from providers in the plan’s network as you go along. Generally, the copays are reasonable, but you’ll want to review them before you enroll to make sure. The plan has the ability to determine which services will have restrictions, such as prior authorization, so you’ll make sure you understand your benefits fully.

These copays can vary from plan to plan as well. For instance, one plan might charge $40 for a specialist visit, while another plan charges $50. Copays can add up while you are using medical services, so think about your medical usage when selecting a plan.

Additionally, Advantage plans can cover benefits that Original Medicare does not cover. Those benefits include routine dental, vision, and hearing services, transportation, gym memberships, telehealth services, and over-the-counter items. Some plans may even provide coverage on hearing aids.

There are no health questions when applying for a Medicare Advantage plan. There are certain times of year that are designated for enrolling in, dis-enrolling from, or changing your Advantage plan.

Check the Drug Formulary

A lot of Medicare Advantage plans also include Part D coverage, so there is often no need to buy a separate drug plan. Some people enjoy the convenience of this.

Most Medicare Advantage plans include a built-in Part D drug plan.

Over the years, however, I’ve seen a few people devastated by this when they weren’t careful to check whether their plan includes the prescriptions drugs they take. They checked all their doctors but didn’t check to see if the built-in prescription coverage included their meds. Then they find out they are stuck in a plan that doesn’t offer an important and usually expensive medication.

You see, Medicare Advantage plans have specific enrollment periods, such as the Medicare Advantage Open Enrollment. If you enroll in a plan, Medicare locks you into that plan through December 31st. You can change mid-year only if a circumstance gives you a special election period, such as moving out of state. This makes it very essential that you choose a plan wisely.

Do your homework on this! (or call us, and we’ll do it for you)

Keep in mind, too, that you must be enrolled in both Medicare Parts A and B to be eligible for Medicare Advantage. Enrolling in Medicare Advantage does NOT mean you get to skip the premiums that you are already paying for Part B. You will continue to pay for Part B.

Know Your Out-of-Pocket Maximum

All Medicare Advantage policies have an Out-of-Pocket (OOP) Maximum Cap to protect you, which limits your costs during the year. In 2022, Medicare has declared that this maximum cannot be any higher than $7,550. However, $7,550 is a lot of money for people on fixed incomes. There will be many years when you won’t come near this, but if you develop a serious illness, like cancer, you can reach it very quickly. Many Medicare Advantage plans have OOP maximums that are lower than the $7,550 limit.

Check the plan’s Summary of Benefits to find out what the OOP Maximum is on the plan you are considering and other information on your potential costs. Then ask yourself- “Do I have enough savings for a rainy day? Can I meet this OOP Maximum if I had to in a year of bad health?”

If the answer is yes, then Medicare Advantage may work fine for you. If the answer is no, then Medigap may be a better fit since the back-end expenses on Medigap plans are minimal and therefore far more predictable.

Changing Between Medicare Advantage vs Medicare Supplement Plans

Many people ask me whether they can start with Medicare Advantage and change to Medigap coverage later if they get sick or need more coverage. That sounds great, right? Just buy the cheapest insurance now until you get sick and then switch back to the more comprehensive insurance?

This is important. It doesn’t work that way. If you leave a Medigap plan to go on Medicare Advantage coverage instead, you may not be able to get back into a Medigap plan later.

Trial Right Exception

You might be outside your one-time open enrollment window by then, and that means Medigap insurance companies can ask health questions on your application. The insurance carriers can decline you for certain health conditions or even medications that you take, so be aware of this before changing to Medicare Advantage. However, there are certain circumstances you should be aware of before you are eligible for Medicare.

Under 65 Exception

Another exception is for people under age 65 who got Medicare early due to a disability. Anyone eligible for Medicare can enroll in an Advantage plan, but many states do not offer all Medigap plans to those under 65 because the Federal law does not require Medigap coverage to those under 65. However, some states including Colorado, California, Maine, Minnesota, Wisconsin, Oregon, and Missouri offer all Medigap plans to those who qualify for Medicare due to certain disabilities. When the person turns 65 and now is eligible for Medicare based on age instead of disability, that person will get a second open enrollment window. They can then change from Medicare Advantage to Medicare supplement without underwriting.

My Best Tips and Advice After Helping 50,000+ People

We’ve worked with thousands of people over the years, and here is my best tip. Plan for a rainy day. Medicare Advantage plans can be quite expensive if you treat for something serious, like cancer. You may pay 20% of chemotherapy or radiation costs up to the plan’s annual out-of-pocket maximum.

That maximum can be as high as $7,550 out of your own pocket – per year! Take the money you would have spent on a higher Medigap plan premium and store it in a savings account each month. These savings fund will be a safety net if you were to be diagnosed with an expensive health condition.

Medicare Supplemental plans have much more predictable back-end spending. For example, with a Medigap Plan G, you know for a fact that you will never pay more than the Part B deductible each year for Medicare-approved services.

Adults who qualify for Medicaid due to low income may consider enrolling in a Medigap plan or Medicare Advantage plan, unless they are a Qualifying Medicare Beneficiary (QMB). In some situations, Medicaid will only help cover the Part B premium, which leaves you responsible for the cost-sharing expenses.

Every situation is different. Contact an Health Insurance Insights agent to help you decide. Our service is free.

Get Help Choosing Between Medicare Advantage vs Medigap

Still asking yourself, “Should I get Medigap or Medicare Advantage?” It’s critical to compare the costs and benefits of each type of plan in relation to your personal healthcare needs and budget as you approach Medicare eligibility. A broker that specializes in both kinds of choices can help you evaluate your options. Some key factors for comparison are:

- Monthly premiums.

- Plan deductibles, if any.

- Expected costs of healthcare services on each plan.

- How often do you use healthcare services?

- Areas where you will need access to care.

- Expected copays for your medications.

- Potential out-of-pocket spending for you on each plan type.

- Remember, you get what you pay for.

Finally, we know that checking the provider networks and drug formularies for each plan can take many hours. Simplify your search by having an Health Insurance Insights licensed insurance agent do this for you. We’ve helped tens of thousands of people like you with their plan options. We can search Medigap vs Medicare Advantage plans in your area and help you weigh the pros and cons of both, so you can choose the right plan for your needs and lifestyle.

We’ll be able to quickly tell you which plans your doctors take and whether your medications are covered. Working with one of our agents also gives you back-end policy support because we offer a Client Service Team for our clients. If your plan ever denies a bill. We provide you with assistance on resolving things like that and that’s why we have hundreds of five-star reviews online here, on Google, on Facebook, and other places.