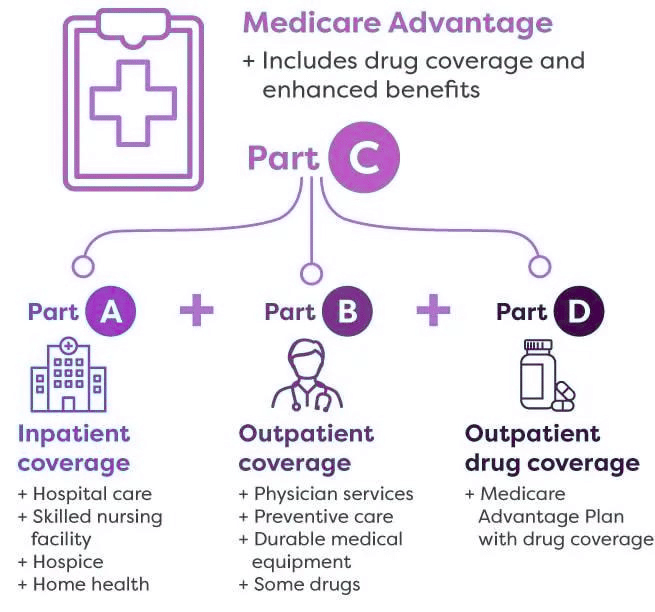

Medicare Advantage

Medicare Advantage plans were created under the Balanced Budget Act of 1997 and signed into law by President Bill Clinton. These plans are commonly called Part C of Medicare. Some doctor’s offices call them replacement plans, more on that below.

Congress designed this program to give Medicare beneficiaries a lower-premium option than Medigap. They also have very little Medicare underwriting. This means they are a coverage option for people who missed their open enrollment window for Medigap and now cannot qualify for Medigap due to health conditions.

Medicare Advantage plans, also known as MA are NOT similar to Medigap plans – they are different. Members get their benefits from a private insurance company instead of original Medicare. As we mentioned, sometimes you’ll hear them referred to as Medicare replacement insurance.

Medicare is not really a fan of this language because it’s not entirely accurate. You never permanently replace your Medicare when you join a Medicare plan. Instead you are just choosing to get your benefits from a private company for the rest of the calendar year. You can always return to Original Medicare during a valid election period.

How Medicare Advantage Works

A Medicare Advantage plan is a private Medicare insurance plan that you may join as an alternative way to get your Part A and Part B benefits. When you do, Medicare pays the plan a fee every month to administer your Part A and B benefits.

You must continue to stay enrolled in both Medicare Part A and B while enrolled in your Medicare Advantage plan. Medicare pays the Advantage plan company on your behalf to take on your medical risk. This is how Medicare Advantage plans are funded.

You will present your Advantage plan ID card at the time of treatment. Your providers will bill the plan instead of Original Medicare. Again, this is also why some providers consider them Medicare replacement plans, but it’s important to remember that you can always return to Original Medicare during a future annual election period.

Each Advantage plan has its own summary of benefits. This summary will tell you what your copays will be for various healthcare services. Your plan will offer all the same services as Original Medicare, such as doctor visits, surgeries, lab work, and so on.

You might pay $10 to see a primary care doctor. Specialists will often be more – a $50 specialist copay is quite common. Some higher copays may come in for diagnostic imaging, hospital stay, and surgeries.

You can usually expect to spend several hundred on copays for these items. However, this varies greatly between states, so review plans in your area to get the specifics.

One neat thing about Medicare Advantage plans is that some of them offer minor benefits for routine dental, vision, or hearing. Some plans include gym memberships. When searching for Medicare Advantage plans with dental and vision, our experts here at Health Insurance Insights can help you compare those ancillary benefits between carriers.

Medicare Advantage Networks

In exchange for lower premiums that advantage plans offer, you agree to play by certain rules. Most Medicare Advantage plans have HMO or PPO networks.

Medicare HMO networks are generally required to treat only with network providers, except in emergencies. You will usually need to select a primary care physician. That physician can coordinate a referral if you need to see a specialist. There are some HMO plans that offer a point-of-service feature where you can see out-of-network providers in certain circumstances.

Medicare HMO plans are the most prevalent type of network. According to a study by Mark Farrah Associates, they will represent 71% of all Medicare Advantage plans on the market.

Medicare PPO networks allow you to see doctors outside the network, but you’ll have substantially higher out-of-pocket spending to do so.

In limited counties, there are Medicare Private-Fee-for-Service plans. These plans may or may not include Part D. How you access to care is also different. While this plan type was very common in the past, it has been slowly phased out in most areas. Read more about Medicare PFFS plans here.

Basic Medicare Advantage Rules

If you are deciding between Medicare Advantage and Medigap, you’ll want to consider some of the rules before you enroll.

- You must be enrolled in both Medicare Part A & B and live in the plan service area. Some people think they can drop Part B if they enroll in Medicare Advantage. That is incorrect If you drop Part B while enrolled, you will immediately be disenrolled from your Medicare Advantage plan.

- Use network doctors and hospitals for the lowest out of pocket costs. Plans may have HMO or PPO networks. Most Medicare HMO plans do not cover anything out of network except emergencies. In PPO networks, seeing a provider outside the network will result in higher spending for you.

- Advantage plans may require prior authorization for certain procedures.

- You may need to obtain a referral from your primary care physician before seeing a specialist on many HMO plans.

Put your red, white, and blue Medicare card in a safe place. Do not give it to any of your healthcare providers. If they bill Medicare, those bills will be rejected because they should have been sent to your Medicare Advantage insurance company for processing.

You must direct your providers to bill your Medicare Advantage plan. People who enroll in Advantage plans for Medicare are agreeing, for the rest of the calendar year, to be covered by the plan instead of Original Medicare.

Basic Medicare Advantage Rules

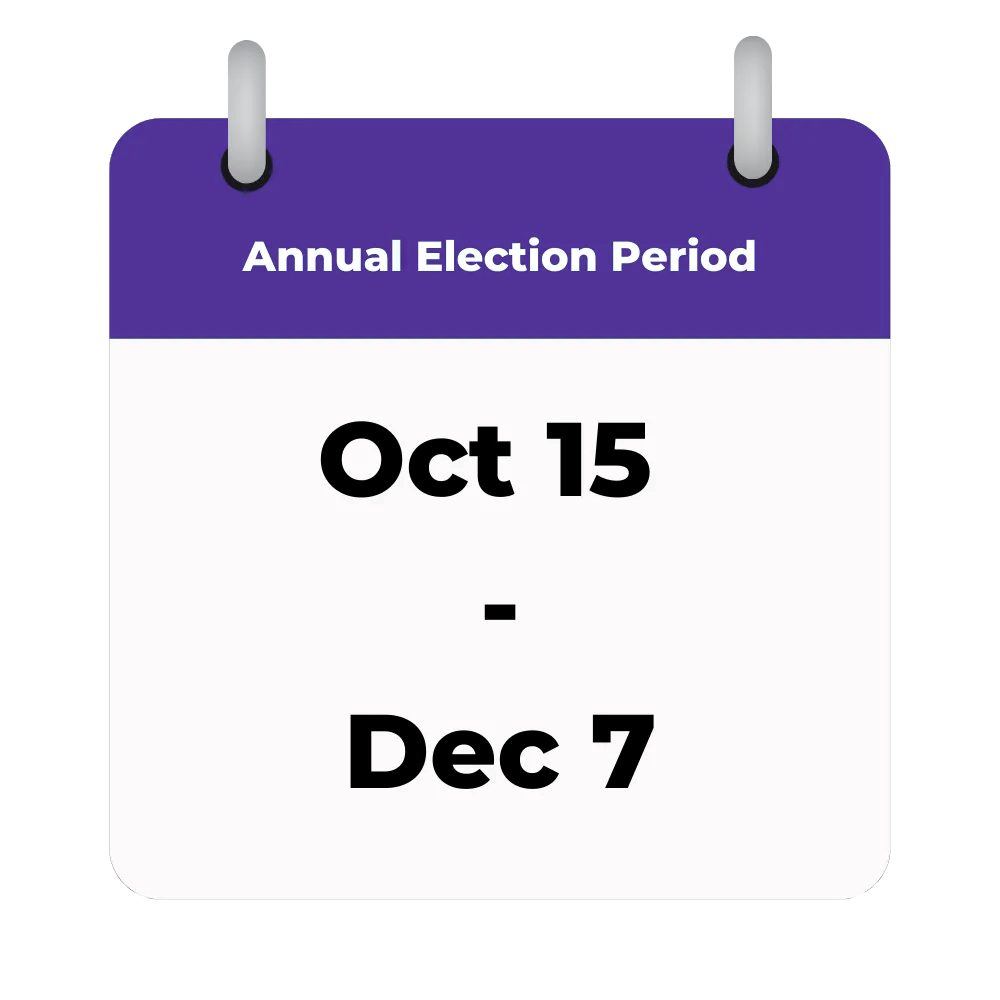

Medicare Advantage plans have lock-in periods. You can enroll in one during the Initial Enrollment Period when you first turn 65. After that, you may enroll or disenroll only during certain times of the year. Once you enroll in Medicare Advantage, you must stay enrolled in the plan for the rest of the calendar year. You may only disenroll from an Advantage plan during certain times of the year unless you qualify for a special enrollment period due to a specific circumstance.

The Annual Election Period in the fall is the most common time to change your Medicare Advantage plan. This period runs from October 15th – December 7th each fall. Changes made to your enrollment will take effect on January 1.

If you decide to leave an MAPD and return to Original Medicare, you must notify your Medicare Advantage plan carrier. Otherwise, Medicare will continue to show that you are enrolled in the Advantage plan instead of Medicare.

Medicare Advantage Open Enrollment Period

Some people join Medicare Advantage plans without doing any research about how these plans work or speaking with an agent who can advise them. Therefore, they don’t know about all of these rules. They may find themselves enrolled in a plan that their doctor doesn’t accept or that doesn’t include one of their medications. This happens most often in January after a person has used the Annual Election Period to join a Medicare Advantage plan.

For this reason, Congress designed the Medicare Advantage Open Enrollment Period that runs from January 1st – March 31st each year. During this time, you can disenroll from any Medicare Advantage plan and return to Original Medicare. You will be allowed to add a standalone Part D drug plan.

Unfortunately, this does not guarantee that you can return to the Medigap plan you had before. Unless this was your first time ever in a Medicare Advantage plan, then you will usually have to answer health questions and go through medical underwriting to get re-approved for Medigap. Consider this before dropping any Medigap plan to go to Medicare Advantage.

Your other option during the Medicare Advantage Open Enrollment Period is to change from your current Medicare Advantage plan to a different Medicare Advantage plan. Please be aware that you can only use this period once per calendar year.

Medicare vs Medicare Advantage

The intent of Congress in creating these plans was to give you options in accessing your Medicare benefits. Some reasons why people might choose an Advantage plan are:

- Many plans have low monthly premiums (although you must continue to pay your Medicare Part B premium).

- You pay for medical services as you use them in the form of copays and coinsurance.

- Unlike Original Medicare, Medicare advantage plans have an out of pocket maximum cap to protect you against catastrophic spending.

- The convenience of having your medical and Part D drug benefits rolled into one plan. Advantage plans with drug coverage are known as MAPDs.

- Some plans may include benefits for things like limited vision coverage. Limitations, copayments, and restrictions may apply.

Remember, it’s a personal choice – there is no right and wrong. Consider Original Medicare vs Medicare Advantage based on your own knowledge of your medical usage.

Without question, Original Medicare with a Medigap plan gives you very comprehensive coverage. The primary differences are that with Medigap plans, you can see any doctor that accepts Medicare. You don’t have to ask your doctors if they take your specific Medigap insurance company. The network is Medicare, which has over 1 million contracted providers across the nation.

Some Medigap plans also have fuller coverage on the back end. Medicare pays 80% and your Medigap plan can pay some or all of the other 20%, depending on which Medigap plan you choose. This leaves you with little out-of-pocket. For example, a beneficiary with a Medigap Plan G won’t have the repetitive copays at the doctor that they might incur on a Medicare Advantage plan.

However, Medigap plans do not include Part D coverage, so you will need to buy a separate Part D policy. They also do not offer any routine dental, vision, or hearing, while some Medicare Advantage plans may at least have a bit of this.

Other Considerations about Medicare Advantage

Be sure to carefully consider these things before joining a plan:

- Not all hospitals and doctors accept Advantage plans. Ask your agent to help you verify whether your medical providers accept the plan you are interested in.

- Advantage plan benefits may change every year. In September, you will receive a packet from your Part C insurance company telling you what is changing. The plan’s benefits, formulary, pharmacy network, provider network, premium and/or co-payments and co-insurance may change on January 1 of each year. Will you be diligent enough to review your annual packet and communicate with your agent if you have concerns about the changes?

- Your enrollment is generally for the entire year. You may only dis-enroll from an Advantage plan during certain times of the year. If you decide in April that you don’t like the plan, you will have to wait until the following annual election period begins in October in order to change your plan, unless you qualify for a special election period.

- If you enroll in one right out of the gate at age 65, you need to be sure you want this coverage long-term. Your open enrollment window to get a Medigap plan with no health questions ends at 6 months past your Part B effective date. You might not be able to get a Medigap plan later if you have health conditions because applying for Medigap later will require you to answer medical questions. You can be turned down for Medigap at that point if you are not healthy enough to qualify.

Do you pay the Part B premium with Medicare Advantage?

Yes, you must first enroll in both Medicare Parts A and B before you are eligible to add on an Advantage plan. This is true even if the Advantage plan itself has a $0 premium. You will still pay your Part B premium to Medicare every month.

How can Medicare Advantage plans be free?

Medicare Advantage plans are definitely not free. Some plans have a $0 premium. This means you pay no premium for the plan itself, but you will still pay the Part B premium to Medicare and you will pay deductibles, copays, and coinsurance as you use your benefits.

When you enroll in a Medicare Advantage plan, Medicare pays the Advantage plan insurance company a monthly fee to take on all of your medical risk. That is the reason why some plans can offer you a $0 premium – they are already getting paid by Medicare on your behalf.

What is a MAPD?

A MAPD is a Medicare Advantage Prescription Drug plan. This would be an Advantage plan that includes drug coverage. Advantage plans that do not include drug coverage are abbreviated to MA.

Conclusion

People often ask us our opinion on which plan is the best Medicare Advantage plan. This varies based on a number of personal factors. What’s right for your friend or neighbor may not be right for you. Don’t risk making a mistake on something as critical as your health insurance. Get help from an experienced agent who can explain your options in detail.

Contact Health Insurance Insights for help today at 813-365-6512! We work with numerous plans in 48 states, and we can guide you through your options.