Types of Medicare Advantage Programs

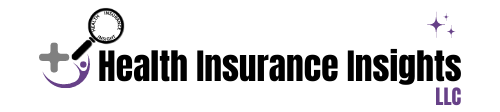

Medicare HMO plans are a type of coordinated care in which you will choose a primary care doctor in the network. You usually must get a referral from that doctor before you can see a network specialist.

Medicare HMO plans often have the lowest monthly premiums of the three types of Medicare Advantage programs. This is because they are generally the most restrictive, requiring a primary care physician. Members visit their PCP first to obtain a referral before they can see a specialist.

Medicare PPO plans are also coordinated care plans but are largely more flexible than Medicare HMO plans. Members can usually see any doctor in the network without a referral. You can also receive treatment outside the network, although you will spend more to do so.

Medicare PFFS (Private-Fee-for-Service) plans largely have no network or a very small network. You can see any doctor who will bill the plan as long as they agree to the plan’s terms and conditions upfront. This puts the burden on you to ask your providers whether they will accept the plan before you seek medical services. These plans have been phased out in many counties where at least 2 other plan types exist.

Always check the rules of your specific plan, which can be found in the plan’s Summary of Benefits.

Other Medicare Advantage Plan Types

In some service areas, there may be less common plan types also available.

Special Needs Plans (SNPs) are available only to Medicare beneficiaries with certain health conditions, or circumstances such as being eligible for Medicaid and Medicare or being institutionalized. The plans are designed to address those health needs with special providers and drug formularies that are most suitable for people with those conditions. Most SNP plans are in an HMO format.

Medical Savings Account Plans (MSAs) offer a health savings account alongside the insurance benefits. Medicare itself will put a set amount of funds into your account each year. You may spend those dollars whenever you access qualifying health services. MSA plans are not available in all counties.

All Medicare Advantage plans offer their own summary of benefits, and these benefits as well as the plan’s formulary, pharmacy network, provider network, premium, and/or copayments/coinsurance may change on January 1 of each year.

Medicare Advantage Enrollment

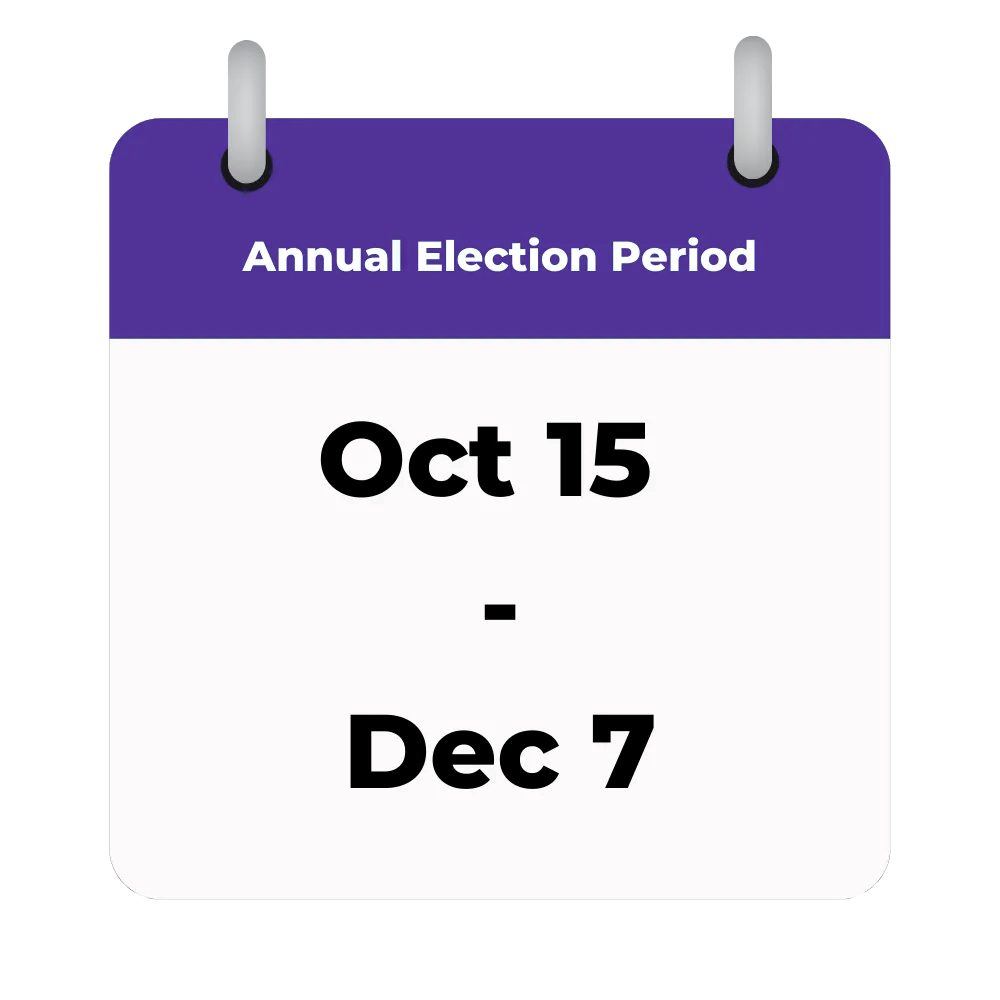

You can join a Medicare Advantage plan during your 7 month Initial Election Period for Medicare. You can also join or disenroll from Medicare Advantage during the Annual Election Period. This occurs in the fall from October 15th – December 7th.

A variety of Special Election Periods exists too. If you qualify, you might be able to join mid-year. A common one is when you move out of state and lose your existing Medicare Advantage plan. Medicare allows you a 63-day window to choose another in your new state. Another SEP occurs if you become eligible for Medicaid or the Part D Extra Help program. People with low incomes have continuous special election periods. This means you can change plans any time of year.

Which Medicare Advantage Programs are Available to Me?

Medicare Advantage programs have service areas. You must be enrolled in both Medicare Parts A and B and live in the plans’ service area. You cannot join a plan that does not operate in the county where you live. A licensed health insurance agent can help you determine which plan options exist in your county. He or she will help you work through a checklist of items to see which plan best suits you.

Find out about plans in your area today by working with a friendly, knowledgeable insurance agent at Health Insurance Insights.